Mastering the Trading Mindset: A Balanced Approach

Mastering the Trading Mindset: A Balanced Approach

Trading in the financial markets is not just about understanding charts and crunching numbers; it’s a mental game where your mindset plays a crucial role in your success. To navigate the turbulent waters of trading, you need a well-rounded mindset composed of discipline, emotional control, and patience. Here, we break down the trading mindset into three essential components: 60% discipline, 20% emotional control, and 20% patience.

#### 60% Discipline: The Backbone of Successful Trading

Discipline is the cornerstone of successful trading. It means adhering to your trading plan, following your strategies meticulously, and maintaining consistency in your actions. Here’s why discipline is so vital:

1. **Adherence to Strategy**: A disciplined trader sticks to their trading plan, avoiding impulsive decisions that deviate from their strategy. This consistency helps in achieving long-term success.

2. **Risk Management**: Discipline ensures that you respect your risk management rules, such as stop-loss and position sizing. This helps in minimizing losses and protecting your capital.

3. **Routine and Practice**: A disciplined approach includes regular practice and continuous learning. Keeping up with market trends, backtesting strategies, and refining your skills are all part of a disciplined trader’s routine.

**Tips to Enhance Discipline:**

– Develop a comprehensive trading plan and stick to it.

– Keep a trading journal to record and review your trades.

– Set realistic goals and establish a routine.

#### 20% Emotional Control: The Steady Hand

Emotions can be a trader’s worst enemy. Fear and greed are powerful forces that can lead to poor decision-making. Emotional control is about managing these feelings and making rational decisions.

1. **Avoiding Impulsive Decisions**: Emotional traders often make impulsive decisions based on fear of missing out (FOMO) or panic selling. Controlling your emotions helps in avoiding these knee-jerk reactions.

2. **Maintaining Objectivity**: Emotional control allows traders to stay objective and stick to their strategy, even in volatile market conditions.

3. **Reducing Stress**: Trading can be stressful, but emotional control helps in reducing this stress, leading to clearer thinking and better decision-making.

**Tips to Enhance Emotional Control:**

– Practice mindfulness and stress-relief techniques.

– Take regular breaks to avoid burnout.

– Focus on long-term goals rather than short-term market fluctuations.

#### 20% Patience: The Silent Strength

Patience is an often overlooked but crucial aspect of trading. It involves waiting for the right opportunities and not forcing trades.

1. **Waiting for Setups**: Patience means waiting for the perfect setup according to your trading plan. It prevents you from entering trades based on incomplete analysis.

2. **Allowing Trades to Develop**: Once in a trade, patience helps you allow it to reach its full potential instead of closing it prematurely out of fear or impatience.

3. **Accepting Market Conditions**: Markets can be unpredictable. Patience involves accepting that not every day will present a trading opportunity and being willing to sit out when necessary.

**Tips to Enhance Patience:**

– Focus on the quality of trades rather than quantity.

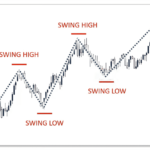

– Use longer time frames for analysis to avoid the noise of short-term movements.

– Trust your analysis and give your trades time to develop.

### Conclusion

Mastering the trading mindset is about finding the right balance between discipline, emotional control, and patience. Each of these components plays a vital role in helping you navigate the complexities of the market and achieve long-term success. By developing and honing these traits, you’ll be better equipped to handle the challenges of trading and turn them into opportunities.

Remember, the journey to becoming a successful trader is a marathon, not a sprint. Stay disciplined, control your emotions, and be patient, and you’ll find yourself on the path to trading success.